On page 2,316 of the US Tax Code under IRC Section 1202 you will find a $10,000,000 capital gains exclusion for Qualified Small Business Stock (QSBS).1 That's right, if you have QSBS and meet the required holding period you can exclude the greater of $10,000,000 or 10 times your cost basis on a stock sale. This article covers one of the best individual tax benefits available today and includes the qualifications, planning opportunities, some frequently asked questions, and two client case studies. Understanding QSBS tax planning is essential for founders, start-up employees, angel investors, and venture capital partners.

What is QSBS?

QSBS is a special tax designation created in 1993 to encourage investment in small businesses. In 2010 Congress passed the Creating Small Business Jobs Act and replaced the original 50% exclusion with a 100% exclusion for QSBS issued after September 27, 2010.

QSBS Qualifications

To qualify for QSBS tax benefits, certain requirements must be met. These include:

-

Legal Structure: QSBS can only be issued by a domestic (US) C-Corporation.

-

Gross Assets Test: A corporation can only issue QSBS when it has less than $50 million of Gross Assets at the time of stock issuance and immediately afterward.

-

Issue Dates: The stock was issued after August 10, 1993 (50% exclusion), between August 18, 2009 and September 27, 2010 (75% exclusion) or after September 27, 2010 (100% exclusion). For eligible stock issued before September 27, 2010, the non-excluded gains are taxed at a 28% federal income tax rate.

-

Qualified Shareholders: Individuals, trusts, partnerships, single-member LLCs, S-Corporations, and regulated investment companies can hold QSBS. C-Corporations cannot hold QSBS.

-

Minimum Holding Period: QSBS must be held 5+ years to qualify under IRC Section 1202 for the capital gain exclusion. However, shareholders may rollover gain from one QSBS-eligible company to another QSBS-eligible company under IRC Section 1045.2

-

Qualified Trade or Business: At least 80% of the corporation’s assets must be used in qualified trade or business activities for “substantially all” of the shareholder's holding period. This excludes companies where the principal asset is the reputation or skill of 1 or more of their employees (e.g. consulting and professional services companies), and banks, financial services, insurance companies, farms, hotels, and restaurants.

-

Original Issuance: QSBS is received directly from the company in exchange for money or other property or as compensation for services provided to the corporation. QSBS status and the established holding period may be preserved for transfers by gift, death, or as a distribution from a partnership. Stock purchased from founders or other early shareholders in secondary transactions is disqualified.

-

Corporate Redemptions: QSBS status can be lost if the corporation redeems more than a de minimis amount of its stock and the purchased stock has an aggregate value of more than 5% of all outstanding shares. The redemption rule is applied using a 2-year window, beginning 1 year before the issuance of the stock. Redemptions from the taxpayer or a related person lower the de minimis threshold to 2% of all outstanding shares with a 4-year window, beginning 2 years before the issuance of the stock.

-

At Risk Capital: QSBS status will be lost if an offsetting short position is established before the 5-year holding period is met. After the 5th anniversary, hedged QSBS will also be disqualified unless an election is made to recognize gains on the date the short position was established.

Planning Opportunities

There are many planning techniques that can potentially enhance the benefits of QSBS. From the strategic early exercise of stock options to leveraging rollover provisions under IRC Section 1045, here is a list of planning opportunities for investors and founders to optimize their QSBS holdings.

-

Marital Doubling: Gifting QSBS to a spouse is a potential strategy for claiming a $20 million exclusion on a jointly filed tax return.

-

Non-Grantor Trusts for Multiple Exclusions: Gifting QSBS to trusts for children or other family members can provide an additional $10 million exclusion for each beneficiary. The trusts need to be non-grantor and separate taxpayers with unique tax IDs. Grantor trusts (including IDGTs and GRATs) are disregarded for income tax purposes and do not provide an additional exclusion.

-

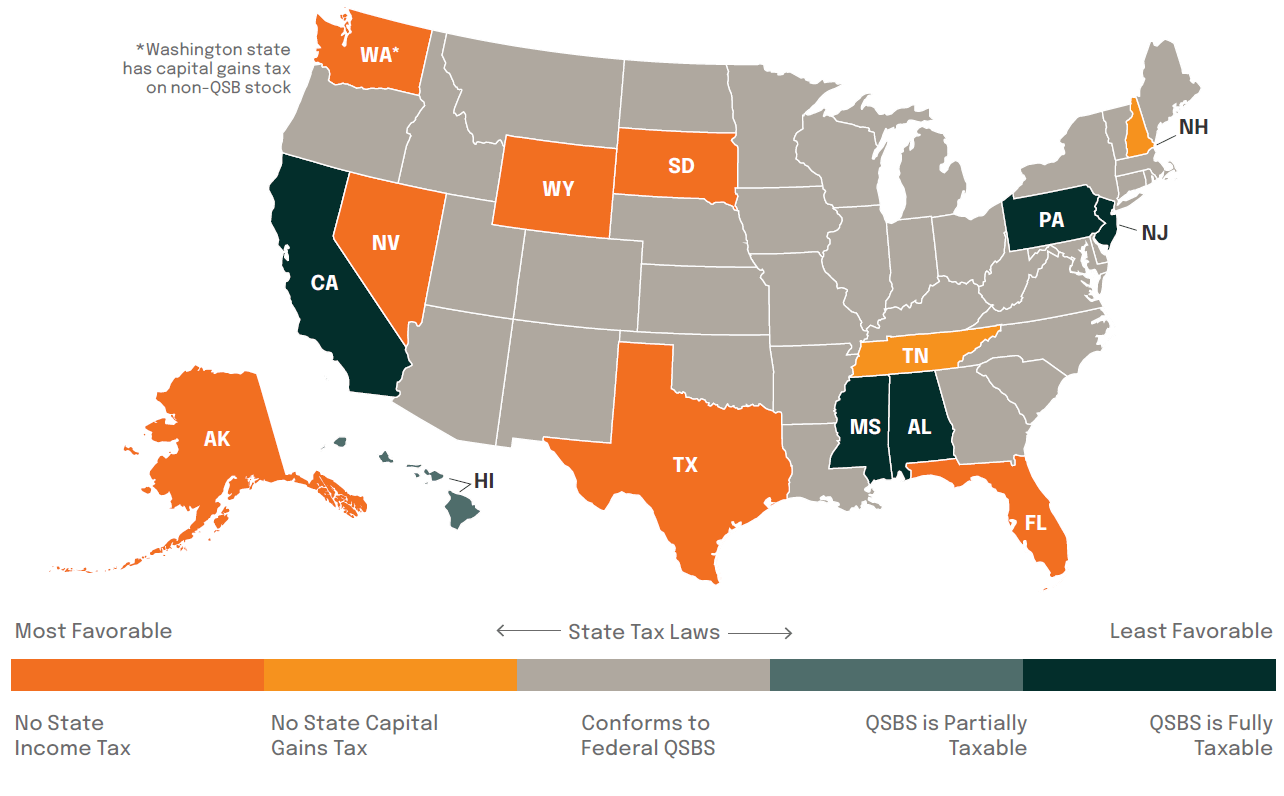

Sell Stock in a Zero Tax State: QSBS is a federal tax benefit, and most states provide similar exclusion benefits for state-level income taxes. However, 6 states do not conform to Federal QSBS: CA, PA, NJ, MS, AL, and HI. Residents of these states can move to a tax-friendly state before selling shares or gift shares to a non-grantor trust in one of the favorable states.

-

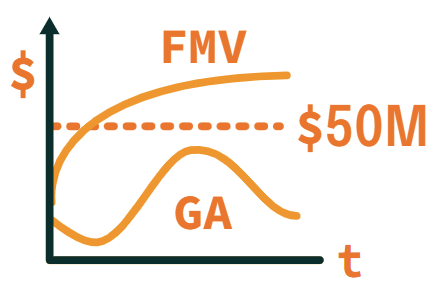

Convert an LLC to a C-Corp for 10x Basis: This strategy involves building up substantial value in an LLC (taxed as a partnership) before converting to a C-Corp. The fair market value of contributed property is used to determine the taxpayer's basis in the new C-Corp. After five years, the taxpayer can sell stock and exclude capital gains equal to 10 times (10x) their basis in the C-Corp. With proper planning, it is possible to far exceed the $10 million exclusion using this strategy.

-

Multi-Year Liquidation: It is possible to claim both the $10 million exclusion and the 10x basis exclusion if stock sales span two tax years and the $10 million exclusion is exhausted first. Stock sold in future years can apply the 10x basis rule on any remaining cost basis.

-

IRC 1045 Rollover: If the 5-year holding period is not met, sale proceeds from QSBS held for at least 6 months can be reinvested in another QSB company within 60 days and the taxpayer can make an election to defer gains.

-

IRC 368 Merger or IRC 351 Exchange: QSBS benefits can be preserved with a properly structured merger or acquisition. In a tax-free corporate merger or exchange, a taxpayer can defer capital gains on start-up stock exchanged for shares of a larger acquiring corporation. The replacement shares acquired by the start-up founder retain the QSBS exclusion benefits and the holding period from the exchanged shares. However, future appreciation in replacement shares stock will be taxable when sold.

-

Carried Interest: Venture capital partners can receive QSBS treatment on their carried interest. The partner must have held their partnership interest at the time the QSBS was acquired by the fund.

-

Partnership Distributions: Investors can receive QSBS treatment on the sale of stock inside of a partnership or on shares originally purchased by the partnership and distributed in-kind to the partners.

-

83(b) Election: An early exercise of non-qualified stock options with a timely filed 83(b) election starts the 5-year holding period for QSBS. For incentive stock options (ISOs), an 83(b) election helps reduce exposure to alternative minimum tax. However, the holding period for QSBS appears to begin when ISOs vest. An 83(b) election can also be filed for restricted stock within 30 days of grant. Without an 83(b) election, the holding period for QSBS begins when restricted stock vests.

-

IRC 1244 Loss: Early investors in a failed start-up may be able to deduct their QSBS capital loss against ordinary income (e.g. W2 wages, dividends, interest). IRC Section 1244 treatment is only available for stock issued before the start-up held $1 million of aggregate capital. The maximum annual deduction is $50,000 per person or $100,000 for a jointly filed return.

-

Documenting QSBS Status: Companies may provide documentation to support a QSBS position, including the gross assets at the time of issuance. Some companies provide a detailed memo, whereas others are less helpful and direct employees to their personal tax preparer for guidance.

-

Tax Opinion Letters: A tax attorney can be engaged to research and help substantiate a QSBS claim with a tax opinion letter. These letters may provide some protection if the IRS takes an adverse position to a QSBS claim on a tax return. If the opinion letter provides substantial authority or reasonable basis (with disclosure on the tax return) for the QSBS exclusion, penalties may be mitigated. However, interest would still be due on any underreported income.

Frequently Asked Questions

What are Gross Assets?

Do Stock Options and Convertible Notes Qualify?

What if the Company's Value Exceeds $50M?

Do SAFEs Start the QSBS Holding Period?

Does S-Corp Stock Qualify?

Can I Deduct QSBS Losses?

Is QSBS Taxable in my State?

Adero Client Case Study 1

Early Exercising Stock Options with an 83(b) Election

Meet Ravi, an engineer at a technology startup in California. When Ravi first joined the company, he was issued incentive stock options (ISOs) with a 6-year vesting schedule. Ravi met with his advisor to provide an update on the new position and discuss tax planning strategies. His advisor mentioned QSBS and walked through the various qualifications. Ravi checked with the company’s leadership and confirmed they had less than $50 million of gross assets and were still issuing QSBS. Since stock options do not qualify as QSBS, Ravi’s advisor recommended early exercising the ISOs to acquire QSBS-eligible shares and filing an 83(b) election to minimize alternative minimum tax.

When the startup was acquired for cash in year 10, Ravi’s QSBS-eligible shares were worth $12.5 million and he could exclude $10 million of federal capital gains. While sharing the good news with his advisor, Ravi learned about another QSBS tax strategy: the IRC Section 1045 Rollover. This strategy could provide federal tax deferral on the remaining $2.5 million of shares from his final vesting date that did not meet the 5-year holding period. Ravi contributed $2.5 million to his own C-Corp start-up within 60 days of the acquisition. The established 4-year holding period on the remaining ISO shares was tacked on to the newly issued QSBS. If Ravi’s new venture is successful, he may be able to claim an additional $10 million exclusion in the future.

In conclusion, Ravi’s decision to early exercise the stock options minimized his tax liabilities and provided tax-advantaged seed capital for his new venture. Ravi’s advisor helped navigate the complexities of the tax code and provided education about the various QSBS qualifications and planning opportunities.

Adero Client Case Study 2

Converting an LLC to a C-Corp for 10x Basis

Meet Amanda, a first-time founder and former C-suite executive. After spending 25 years climbing the corporate ladder, Amanda stepped away and began a sabbatical to recharge and explore some ideas for her own company. Amanda met with her advisor to discuss cash flow needs and her plans for the future. Amanda’s advisor introduced the QSBS concept and identified a potential strategy to enhance future QSBS benefits.

Her advisor recommended forming an LLC and building value before raising venture capital to take advantage of the 10x basis rules for QSBS. When an LLC is converted to a C-Corporation, the basis for QSBS purposes is the full fair market value of contributed property received in exchange for founders stock. Amanda took the advice and formed an LLC. 2 years later, Amanda was able to raise a priced-round of venture capital at a $20 million valuation, while converting the LLC to a C-Corporation. As the sole owner of the LLC, Amanda now has $20 million of basis in her company and a potential exclusion of up to $200 million in capital gains.

In summary, Amanda’s decision to utilize an LLC entity structure for her startup magnified the potential tax benefits of QSBS. Amanda’s advisor provided critical guidance early on and helped her maximize the value of her equity.

Conclusion and Resources

Understanding QSBS tax planning is essential for founders, start-up employees, angel investors, and venture capital partners. A wealth advisor with tax expertise can help you identify QSBS and navigate the various rules and planning opportunities.

For more information on QSBS, you can explore these resources:

Discover how Adero Partners can help

Optimize Your Wealth with QSBS

Contact Aaron White - aaron@aderopartners.com